How definitive are Olympic results? The answer is as varied as the scoring systems the events employ. For many Olympic competitions a team tallies wins and losses–a set of nominal variables. Such variables are qualitative and  considered to be of the lowest level of measurement. They ask a question (e.g. won?, lost?). The data answer the question with either true, represented by one, or false, represented by zero. Nominal categories must be mutually exclusive–one cannot both win and lose a particular game. The categories must also be fully exhaustive–a team must win or lose any game played. This method of determining a winner often satisfies spectators because outcomes are usually indisputable. Because a team’s record places equal value on all wins, it cannot be objectively compared across time periods. Opponents and skill levels change. Whether a current team is better than a previous team therefore becomes primarily a matter of opinion.

considered to be of the lowest level of measurement. They ask a question (e.g. won?, lost?). The data answer the question with either true, represented by one, or false, represented by zero. Nominal categories must be mutually exclusive–one cannot both win and lose a particular game. The categories must also be fully exhaustive–a team must win or lose any game played. This method of determining a winner often satisfies spectators because outcomes are usually indisputable. Because a team’s record places equal value on all wins, it cannot be objectively compared across time periods. Opponents and skill levels change. Whether a current team is better than a previous team therefore becomes primarily a matter of opinion.

At the other end of the spectrum is the ratio scale. Two relevant examples are time and distance. Ratio variables have two simple criteria. First, zero has to represent nothing. The zero-minute-mile is eternally elusive and zero-meter javelin tosses denote a complete lack of ability. Second, when a value is doubled it must mean double the value. Four minutes is twice the duration of two minutes and six yards is twice the length of three yards. These results can be compared across time periods. Whether examining the luge, shot put, or high jump, today’s Olympians can be directly compared to those from the past. Ratio level measurement is necessary for world records.

Ordinal measurements lie somewhere between nominal and ratio scales. They can be put in order, but the distances between them contain no additional information. Judges give ordinal scores. Higher means better, but we cannot say how much better. Two additional points from judges today are not equivalent to two additional points from judges yesterday, last year, or in 1980. Fans have to accept that ordinal scores are subjective and cannot be compared across time (or even across judges).

So, to start a discussion about an event’s greatest athlete, choose an event judged on a nominal or ordinal scale. Debating one with a world record holder won’t give you much to talk about.

The number of bathrooms in a student’s house is highly correlated with his or her ACT scores. Why? When a house has a greater number of bathrooms, the property value of that house increases. When property values go up, so do property taxes. This leads to better funded local schools. Such schools produce students that do relatively better on standardized tests. Without controlling for more relevant variables, one might argue that more toilets lead to better test scores. This illustrates the importance of theory in the practice of statistics.

When discussing the difference between correlation and causation I am often asked, “But what if one event always occurs before the other one?” Often when I am flying, the pilot will flip on the “fasten your seatbelt” sign several minutes before the plane hits some turbulence. Based on the logic that causation can be shown if one event regularly occurs before another, I could conclude that pilots cause turbulence by turning on seatbelt lights.

A disproportionate amount of DUIs are given to people driving older vehicles. People who drive older vehicles tend to be poorer. Are the police actively looking to punish poorer people by targeting older cars when deciding which cars to pull over late at night? Not necessarily. An officer I know told me that someone driving without their headlights on after midnight is the most common signal of intoxication. Newer vehicles don’t allow for drivers to make this mistake because of automatic lighting systems. Simple statistics might lead one to conclude that police are biased against poorer drivers. A little insight tells us that wealthier drivers just have an additional protection against signaling intoxication.

An energy crisis plagues the Western world. Diminishing supplies and increasing transportation costs are driving up prices. Fuel sources are drying up. Many fear that the current way of life will become unsustainable. Families spend escalating proportions of their income on simple amenities such as heating their homes.

The previous paragraph may accurately depict the modern world. However, it was written about Europe in the sixteenth century. In Before the Industrial Revolution,  Carlo Cipolla explains that timber remained the primary fuel of Europeans until the late 1600s. Only when coal was increasingly used as a substitute did timber prices began to diminish. So why did the Europeans wait so long to start burning coal? The answer is that at low prices it simply wasn’t worth the time or effort to extract the coal from the ground. When timber prices rose, coal sellers could undercut the price and still make a profit. This is the law of supply–as the price increases, more people are willing to supply a good.

Carlo Cipolla explains that timber remained the primary fuel of Europeans until the late 1600s. Only when coal was increasingly used as a substitute did timber prices began to diminish. So why did the Europeans wait so long to start burning coal? The answer is that at low prices it simply wasn’t worth the time or effort to extract the coal from the ground. When timber prices rose, coal sellers could undercut the price and still make a profit. This is the law of supply–as the price increases, more people are willing to supply a good.

High oil prices lead to talk about increased consumer costs and windfall producer profits while the most promising aspect is often ignored. Necessity is indeed the mother of invention (and innovation). The resolution to our generation’s fuel problems will most undoubtedly be the same solution as four centuries ago: the development of new energy sources. The need to develop new energy wasn’t there when oil was relatively cheap. High oil prices incentivize the development of new competitive energy sources and methods.

Even the commode is not immune from economic activity. I find two examples especially interesting.

The law of demand states that as something becomes more expensive, people choose to consume less of it. Electronic towel dispensers are a perfect example of this concept involving non-monetary prices. Pulling our own paper towels is no great task, so why do these machines exist? I suggest towels from automated  machines purposely cost more to users by requiring more time per sheet. Because of the higher price, the restroom operator knows that fewer towels will be taken per wash. As fewer towels are consumed, less restocking occurs, and eventually the room operates at a lower cost.

machines purposely cost more to users by requiring more time per sheet. Because of the higher price, the restroom operator knows that fewer towels will be taken per wash. As fewer towels are consumed, less restocking occurs, and eventually the room operates at a lower cost.

Similarly, bathroom attendants make hand-washing more costly. If you choose to tip bathroom attendants, handwashing becomes more expensive. Attendants can also make those who do not tip feel uncomfortable or annoyed, thereby raising their costs. For both groups, handwashing costs more, so people choose to have less of it. Economic reasoning allows us to see the public health implications associated with letting an attendant set up shop.

There is another interesting story here. To see it, you need to note that handwashing and trips to the lavatory are complements (items consumed together). Theory states that as the price of a complement good (handwashing) increases, people will demand less of the original good (stops at the loo). The punch line is that washroom attendants drive people to use bathrooms less frequently, which is rough news for our poor bladders.

Hockey has a strange system to determine who makes the playoffs. Each team receives two points for every match they win, zero points for every match they lose in regulation and one point for each game that they lose in overtime. This point total, not overall record, determines which teams make the playoffs.

For simplicity, let’s assume in any given match that each team has an equal chance of winning. The expected value for any regulation match is one point (the average of the winner’s two points and the loser’s zero) and the expected value for any overtime match is one and a half points (the winner gets two, the loser gets one).

In-conference matches involve one team trying to gain ground on the other. The expected value is not important. In this situation, teams only care about the expected gain (or loss) in points relative to their opponent. An overtime win results in a net gain of one point while a regulation win awards a net gain of two.

Teams from different conferences don’t compete with each other for playoff spots. So while teams playing within their conference care about expected gain, teams playing outside their conference care about expected value. If teams try to maximize these values, they will prefer for conference games to end in regulation and non-conference games to go into overtime. This affects third period strategies in close games. More importantly, it provides plenty of incentive for unspoken collusion between teams in different conferences.

Expected value is a concept that allows us to factor in the probability of an uncertain event into our calculations. Imagine that you have a summer roofing job in Sandy, Oregon. I chose Sandy because it gets 182 precipitation days per year so on any given day there is a 50% chance of not working due to the weather.  If you get paid $80 per day worked and $20 when you do not work due to rain, what should you expect to make in a twelve-week summer? Let’s break this down into a smaller problem.

If you get paid $80 per day worked and $20 when you do not work due to rain, what should you expect to make in a twelve-week summer? Let’s break this down into a smaller problem.

The expected value of any given workday is the average of the payment received for working ($80) and not working ($20), which is $50. This is because there is an equal chance of either type of day occurring. By extension, the expected value of a five-day work week is $250 and of total summer income is $3,000.

What does this have to do with betting? A fair bet has an expected value of zero. For example, a bet of $10 on a coin flip is fair. There is an equal chance of losing or gaining $10. The average of these two values (+10 and -10) is zero. Casinos make their money by offering unfair bets. The expected value of (almost) every casino bet is negative (and none of them are positive). They cannot collect a guaranteed profit from a fair game so they count on you to play a rigged one. What do you suspect about the expected value of casino profits?

Economists and accountants are often thrown into the same category. Accountants look at dollar values. What differentiates the economist is the addition of a concept called opportunity cost. One of my favorite examples of this involves a friend offering you $500 to help him move. If this is an uneventful day, you will probably help. If it is a holiday, you may decline. If it is Super Bowl Sunday and you have tickets to the game, you most likely will decline. The key is that you have to weigh all of your other options before making a decision.

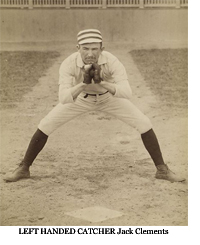

In his book, The Baseball Economist, J.C. Bradbury offers one of the most intelligent arguments I have ever heard for the absence of left-handed catchers. Since 1902, a left-handed catcher has been used in only sixty-three games. Bradbury sifts through some of the common arguments of why they rarely exist (difficulty throwing to third base, coordination with pitchers, throwing errors, etc.). Through cost-benefit analysis, he dismisses most of these as insignificant.

In his book, The Baseball Economist, J.C. Bradbury offers one of the most intelligent arguments I have ever heard for the absence of left-handed catchers. Since 1902, a left-handed catcher has been used in only sixty-three games. Bradbury sifts through some of the common arguments of why they rarely exist (difficulty throwing to third base, coordination with pitchers, throwing errors, etc.). Through cost-benefit analysis, he dismisses most of these as insignificant.

Where he concludes is extremely insightful. Being a catcher requires intelligence, a strong arm, and good vision. If you are left-handed and have these qualities, your coach is most likely not going to position you as a catcher. He will use you where your talents are most valuable–as a pitcher. No real bias against left-handed catchers exists. The cost is just too great to waste a southpaw at catcher when he could be stepping on the mound.

Picture a Coke machine next to a Pepsi machine. Let’s say a Coke and Pepsi each cost $1 today. Tomorrow, the price of Coke jumps up to $2. What do you expect will happen? Two things should come to mind. First, fewer people will buy Coke. It’s more expensive. This is the law of demand. The second effect is that some people will now switch from Coke to Pepsi. They are substitutes–when the price of one increases, people buy more of the other. Here are some interesting examples:

Certain nationalities have a relatively harder time gaining American citizenship through immigration and/or naturalization. We’d expect to see an increase in demand for substitutes among these groups. The closest substitute for naturalization is marriage to a U.S. citizen. U.S. immigration policy not only shapes the international marriage market, it does so with national bias.

In times of economic trouble, finding work can be tedious. It requires dedication, persistence, and patience among other things. When job search costs are high, we expect to see an increase in demand for substitutes. The three that come to mind are government assistance, crime, and civil lawsuits.

In times of economic trouble, finding work can be tedious. It requires dedication, persistence, and patience among other things. When job search costs are high, we expect to see an increase in demand for substitutes. The three that come to mind are government assistance, crime, and civil lawsuits.

Huffing is the act of getting high by inhaling toxic fumes. Minor headlines revolve around fears of epidemics among teens. How can we reduce the amount of huffing? Increase the availability of substitutes. Keep some beer in the garage next to the paint. Fewer kids will choose a chemical high when alcohol becomes more available.

“My boss can’t find anything without me.”

“He’s a slob–his mother constantly cleaned up after him.”

“I can’t spell–I’ve got spell-check.”

Simply put, economics is nothing more than the study of decision making. Whether we’re car shopping, eating out, or contemplating stealing, part of us asks “What will this really cost me?” This implies that weaker punishments lead to more crime, but what about incentives involved in everyday bad behavior?

Housekeepers reduce the cost of untidiness; so those who use these services are messier than they would be without them. Similarly, spell-check reduces the cost of misspellings; while administrative assistants maintain the incentive for the big boss to remain unorganized. The stakes can get larger, however.

Housekeepers reduce the cost of untidiness; so those who use these services are messier than they would be without them. Similarly, spell-check reduces the cost of misspellings; while administrative assistants maintain the incentive for the big boss to remain unorganized. The stakes can get larger, however.

In The Armchair Economist, Steven Landsburg suggests that safety regulations (seatbelt laws, mandatory air bags, etc.) increase the number of accidents. He argues that the cost of driving carelessly is lowered in terms of expected injury or death. Likewise, competent nurses diminish the costs of doctors making mistakes, leading to more errors. Birth control reduces the cost of unprotected sex, thereby increasing its frequency.

What about those who never had the incentive to learn how to be good drivers, competent doctors, or responsible sexual partners? Much like spell-check users on a handwritten exam, when these individuals leave their coddled environment, they cannot simply switch to demonstrating good behavior because they never learned good habits in the first place. Once they lose their safety nets, the potential damage they can inflict greatly increases.

Recently, an interesting feature has been made available on many new jukeboxes. It charges customers a higher amount (usually double the regular cost) to hear selections immediately.

This factor aims to take advantage of the diverse time preferences (what economists call discount rates) that exist among customers. Those who are more determined to hear songs now (and therefore pay extra) are said to have a relatively high discount rate, those who are more willing to wait have a relatively low discount rate.

Compared to the system of “first come, first served”, this is a downgrade for most consumers. Ideally, these additional fees would be transferred to individuals that were skipped to reimburse them for doing so. You can sense the inefficiency because jukebox makers can generate additional revenue by producing no additional service. They do this by pitting customers against each other, essentially accepting bribes to let some avoid waiting.

I do not suggest this system cannot produce better results, only that at a low price, it won’t, due to overuse. After a point, the more customers that use the feature, the worse are the results. Simply illustrated, the worst case scenario occurs when everyone has a high discount rate and pays extra for the option. This has the same result as if none of them do, but costs twice as much.

Will an option to skip someone’s song ever be offered? Jukebox owners would have opportunities to charge double and produce zero. Sounds like a cushy job to me.

The role of government has been debated since the days of Plato. The debate may never be settled. There may something many can agree on, however. The ideals of soft paternalism suggest that the state can often point you in the right direction without removing freedom of choice from the situation. By changing the default setting, behavior can be changed.

To many economists, this doesn’t make sense. For example, imagine two boxes. One has a cupcake and the other a donut. I allow you to pick a box, I take the other, and we open both. Once you’ve seen both items, I give you the choice of the two. Economic theory states that you always select the item you prefer more. This is not what always occurs. People tend towards the status quo–choosing the one they received first. For more on this see this article by Jack L. Knetsch.

An article from The Economist states that 49% of people who start a new job will sign up for a pension plan if paperwork is required to join, where 86% will remain in the pension if paperwork is required to opt out. If we believe more people should be saving for retirement, changing this default value can make society better off, while still preserving individual choice. Recently, organ donor programs have been pushing for a similar change in the status quo. See the USA Today article on opt-out donor programs.

An article from The Economist states that 49% of people who start a new job will sign up for a pension plan if paperwork is required to join, where 86% will remain in the pension if paperwork is required to opt out. If we believe more people should be saving for retirement, changing this default value can make society better off, while still preserving individual choice. Recently, organ donor programs have been pushing for a similar change in the status quo. See the USA Today article on opt-out donor programs.

Earlier this year an article by Dr. Kirsten Bibbins-Domingo et al. in the New England Journal of Medicine suggested that moderately lowering salt in diets should be a public health target. While some view this as the long arm of government reaching too far into our kitchens, I see it as another form of soft paternalism. As any chef will attest, you can’t cook salt out of a dish. Now those who prefer lower salt meals can have them and those who want to add salt can do so freely. The spectrum of choice is greater and the change in the status quo might end up promoting public health.

In the spring of 2011, Ray Lewis made the prediction that crime would increase if the NFL lockout prevents the football season from occurring. For some people, like the kids mentioned in his statement, football is a substitute for causing trouble. Ray Lewis (and subsequently LaVar Arrington) left out half the story. A group exists that causes crime because of football. Examples include football drunks and overly aggressive fans (e.g. the baseball incident in May 2011).  Without football, the first group will cause more crime while the second group will commit less crime. Due to the uncertainty of the relative sizes of these two groups, predicting the end result is not so easy. I would’ve suggested that crime would decrease, but I am no better of a predictor as we are all victims of the same type of bias.

Without football, the first group will cause more crime while the second group will commit less crime. Due to the uncertainty of the relative sizes of these two groups, predicting the end result is not so easy. I would’ve suggested that crime would decrease, but I am no better of a predictor as we are all victims of the same type of bias.

Mr. Lewis and Mr. Arrington believe the number of aspiring players is larger than unruly fans. I suggest the opposite. Why? Tversky and Kahneman’s availability heuristic suggests that we tend to think there are more of the types of people or things that can easily be brought to mind. The aforementioned NFL players believe that in the average community there are more aspiring athletes than fans. They grew up in such communities. I grew up in a place with relatively more fans, so I fall for the same type of selection bias by asserting the contrary. None of us has experienced the random sample necessary to make a reliable estimate. One of us is likely right, but based on poor methods of estimation.